Insights

Pressure on Out of Network Billing: the Critical Issue in Healthcare Services M&A Valuations

By Jeff Swearingen and Saskia Siderow –

Mergers and acquisitions in the healthcare services sector are hitting an unexpected stumbling block: buyers are no longer willing to pay more for revenues billed at out-of-network rates. Hospitals, physician groups and other clinicians have relied on the ability to operate outside of insurance networks as a means of boosting their bottom lines, and as a negotiating tool to secure higher in-network rates from payors. But the strategy has come under significant pressure from recent payor efforts to reduce their share of out-of-network payments and growing legislative interest in protecting patients from “surprise” medical bills received for out-of-network care. Prospective buyers of healthcare services organizations have become wary of overpaying for out-of-network revenues that may decline, and are now calculating expected earnings on the assumption that all future revenues will be paid at more modest in-network rates. The shift has opened up a significant valuation gap between buyers and sellers, and this gap is arguably the biggest impediment to transactions in the healthcare services market today.

Payors are reducing out-of-network reimbursement levels

For decades, the market standard for reimbursing out-of-network providers was for payors to determine a so-called “usual and customary” level to pay based on market rates. Insurance companies typically calculated these usual and customary amounts by looking at a distribution of provider “billed charges” – the amount providers request for a given service – and selecting a percentile of those billed charges as the “allowed charge” for insured beneficiaries. Patients could then be asked to pay the difference between the billed charge and the allowed charge, in addition to their co-pay or deductible, in a practice known as “balance billing”. The insurance companies’ methodology for calculating usual and customary rates led to substantial inflation in billed charges as providers sought to maximize both their out-of-network and in-network reimbursement – providers dissatisfied with their in-network rates could threaten to go out-of-network, thereby forcing payors to sweeten their contracted in-network rates.

The providers with the most power in these negotiations are typically providing care in circumstances where it is unusual for patients to select their provider based on network affiliation: for example, emergency medicine, transport, radiology and anesthesiology. While comprehensive data on commercial payment rates by specialty are not widely available, evidence suggests that these specialties receive the highest contracted in-network rates, and are also responsible for the highest rates of balance billing. Emergency physicians receive average contracted payment from commercial health plans at roughly 250-300% of Medicare rates, and anesthesiologists average nearly 350% of Medicare rates, for example, compared with mark-ups over Medicare for non-emergency services of between 115-200%.1

But the tide is turning. Payors have begun experimenting with strategies to reduce their out-of-network costs and put further pressure on their contracted rates. Most of these strategies involve jettisoning providers’ lists of standard billed charges and instead anchoring out-of-network reimbursement to some other more objective framework. This includes paying out-of-network providers at a multiple of Medicare rates, paying them at in-network levels, or designing new “usual and customary” charge schedules linked to Medicare or other data. Some health plans have opted to negotiate payments on a case-by-case basis, sometimes taking their disputes public to push for an agreement. For example, insurer UnitedHealthcare and physician staffing company Envision Healthcare renewed their contract for 2019 after months of public legal wrangling. Envision provides staff to hospital emergency, anesthesiology and radiology departments around the country. UnitedHealthcare claimed Envision demanded excessive prices for its services and contributed to the high cost of emergency department visits. For its part, Envision claimed that UnitedHealthcare demanded “massive cuts” to allow its physicians to stay in network. The details of the final contractual agreement were not made public, but the dispute is indicative of health plans’ new approach to negotiations.

Legislators are sponsoring patient protections from surprise bills for out-of-network care

As payors work to reduce their reimbursement levels for out-of-network clinicians, they have also enlisted state and federal legislators to make it harder for providers to collect payments directly from patients. Patients are frequently caught in the middle of price inflation for healthcare services, leading to finger pointing at the insurers for paying too little of the out-of-network billed charges, and at providers for over-charging and non-disclosure of list prices for services. Historically, insurers have taken the brunt of the blame, but in recent years, instances of providers abusing balance billing with outsized charges have attracted media attention2 and sparked public outrage, particularly when patients received out-of-network care in circumstances that could not reasonably be avoided, such as emergency ambulance transport. An estimated 51% of emergency ambulance services and 19% of emergency department visits result in out-of-network balance bills, but the practice is also prevalent with elective care, with 9% of elective inpatient stays resulting in out-of-network balance bills.3

The health insurance industry has successfully reframed these cases as “surprise billing,” placing the blame more squarely with providers, while state and federal legislators on both sides of the aisle have seen an opportunity to pass healthcare legislation that addresses a common concern among voters. In a recent survey, the Kaiser Family Foundation found that almost 40% of insured adults under 65 say they received care from a doctor, hospital or lab in the last 12 months that they thought was covered, and that their health plan either didn’t cover or covered less than expected. For 10% of insured adults under 65, the surprise bill was related to care received from an out of network provider. Indeed, unexpected medical bills were the most common financial concern for Americans, with two-thirds of those surveyed saying they were either very worried or somewhat worried about being unable to afford an unexpected bill. More than three quarters of those surveyed said that they wanted the government to take action on surprise medical bills.4

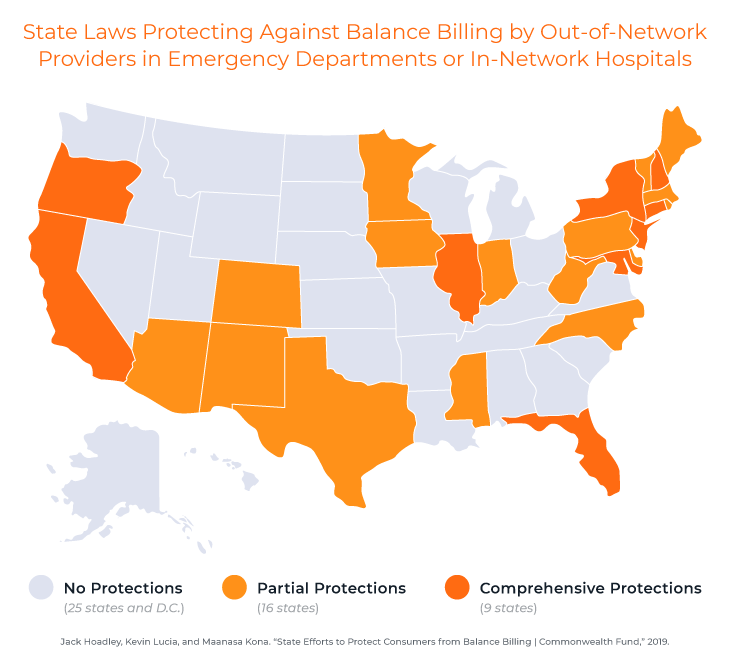

At the end of 2018, 25 states had laws offering some balance billing protection to their residents, and nine of those states – California, Connecticut, Florida, Illinois, Maryland, New Hampshire, New Jersey, New York, and Oregon – offered comprehensive protections.5 The nature of protections vary from state to state, but can include protections for patients receiving care in emergency department and in-network hospital settings, extending protections to all types of insurance plans governed by state law (including HMOs and PPOs), prohibitions on balance billing or holding patients harmless, and setting payment standards or dispute resolution processes for providers and payers.

There is also growing interest in federal measures to protect patients from balance billing, given that self-funded insurance plans – representing 60% of privately-insured adults – are not governed by state regulation, which is pre-empted by the 1974 Employee Retirement Income Security Act (ERISA). Several bipartisan proposals were presented in both the House and the Senate during the last Congress, President Trump called on Congress to act on the issue in May, and in June, a key Senate committee approved a bill that would benchmark out-of-network payments to median in-network rates. The House Energy and Commerce committee is working on similar legislation. Federal proposals vary in their approaches, some calling for payment standards and benchmarking, and others on dispute resolution mechanisms. Lobbying pressure is set to ratchet up over the next few weeks and months until legislation finally reaches the floor. While it is unclear what can be achieved in this divided Congress – especially if patient protections for balance billing are attached to other less bipartisan healthcare measures – federal restrictions on balance billing practices are only a matter of time.

Buyers and sellers of healthcare services face a valuation gap

Legislation against balance billing cuts providers off at the knees in their negotiations with payors, turning all but the largest providers into rate takers instead of rate setters. Health plan members will no longer be stung with balance bills from out-of-network providers that the insurers refused to contract with, while providers may be tied to defined payment schedules or forced into dispute resolution. Out-of-network reimbursement rates will decline as a result, prompting buyers of healthcare services companies to be increasingly cautious about calculating future earnings when they value their targets. Sellers, on the other hand, are generally still relying on out-of-network revenue streams as a given, opening a meaningful valuation gap in healthcare services transactions.

The extent to which different specialties rely on out-of-network revenues varies widely by specialty and also by geography, so it is difficult to assess the impact on valuations market wide, but consider the following hypothetical case study example. Hometown Radiology Associates (HRA), a staffing service to hospital radiology departments, is considering a sale to Health Opportunities, a private equity fund. Table A shows the total revenue and volume by payor for HRA under two scenarios: (i) as reported total revenue by payor, and (ii) pro forma total revenue assuming the two out-of-network commercial payors convert to in-network payors, at an in-network rate equal to the weighted-average of current in-network commercial payors ($199.55 in this example). Under the second scenario, revenues are $2,109,000 lower than current reported revenues, translating into lower practice profits (EBITDA), since operating costs are fixed.

Table A:

Table B compares a summary of revenue and practice profits for HRA and the corresponding implied valuation for two different scenarios. HRA’s valuation, the “seller ask”, shows the revenue and EBITDA on an “as reported” basis, whereby the two out-of-network payors remain at their current reimbursement levels. This scenario applies an 8.0x multiple to the as-reported EBITDA which reflects HRA’s valuation expectations. Health Opportunities’ valuation, the “buyer bid” shows the revenue and EBITDA assuming that out-of-network reimbursement converts to in-network reimbursement. In this scenario, the reduced EBITDA is partially off-set by a larger EBITDA multiple of 12.0x, since Health Opportunities is willing to pay for a practice with reduced reimbursement risk. But the different valuation methodologies nevertheless open up a significant valuation gap – HRA thinks its practice is worth $38.5 million, and Health Opportunities is only prepared to pay $32.5 million.

Table B: If we take the analysis a step further, in Table C, we show the downside cases for Health Opportunities and Hometown Radiology Associates, if they accept the alternative valuation and are later proved wrong. If Health Opportunities pays HRA’s ask and the practice is forced in-network after the transaction has closed, they will have effectively paid a 14.2x multiple for the practice, whereas if HRA accepts Health Opportunities’ bid and the practice retains its out-of-network rates post close, HRA will have effectively received a 6.7x multiple for the practice.

If we take the analysis a step further, in Table C, we show the downside cases for Health Opportunities and Hometown Radiology Associates, if they accept the alternative valuation and are later proved wrong. If Health Opportunities pays HRA’s ask and the practice is forced in-network after the transaction has closed, they will have effectively paid a 14.2x multiple for the practice, whereas if HRA accepts Health Opportunities’ bid and the practice retains its out-of-network rates post close, HRA will have effectively received a 6.7x multiple for the practice.

Table C: Closing this gap in valuations will be critical to the next phase of the healthcare M&A cycle. Healthcare practices are losing a key tool in their rate negotiations with payors, but for many, this will mean that the pathway to continued negotiating power is to aim for scale. Larger practices will be able to command higher contracted rates from the health insurers, and enjoy higher valuations as a result.

Closing this gap in valuations will be critical to the next phase of the healthcare M&A cycle. Healthcare practices are losing a key tool in their rate negotiations with payors, but for many, this will mean that the pathway to continued negotiating power is to aim for scale. Larger practices will be able to command higher contracted rates from the health insurers, and enjoy higher valuations as a result.

___________________

Jeff Swearingen is co-founder and Managing Director of Edgemont Partners, an independent healthcare investment banking firm in New York. Jeff has focused on healthcare for his entire career, since starting as an accountant at KPMG’s Healthcare and Life Sciences Group in 1994. He co-founded Edgemont in 2001 and leads Edgemont’s clinician advisory practice.

Saskia Siderow, MPH, is founder and Managing Director of Ormond House, a healthcare services research and strategic communications consultancy.

About Edgemont Partners

Edgemont Partners is a premier investment bank that provides merger and acquisition advisory and growth capital raising services exclusively to healthcare companies. We focus solely on providing expert strategic advice and transaction execution, bringing a steadfast commitment to our clients, driven always by what’s in their best interest. This dedication enables us to deliver independent conflict-free advice, to serve as trusted advisors to healthcare entrepreneurs, management teams and investors, and to execute with exceptional results.

________________________

1 Adler, Loren, Matthew Fiedler, Paul B Ginsburg, Mark Hall, Erin Trish, Christen Linke Young, and Erin L Duffy. “State Approaches to Mitigating Surprise Out-of- Network Billing,” no. February (2019).

2 Rosenthal E. After surgery, surprise $117,000 medical bill from doctor he didn’t know. New York Times . 2014 Sep 20; Fletcher H. “Surprise bills” shock those who choose in-network care. USA Today [serial on the Internet]. 2016 Mar 18; Cates-Carney C. A lifesaving flight with a price tag of $56,000. Kaiser Health News [serial on the Internet]. 2016 Jan 21

3 Garmon, Christopher, Benjamin Chartock. 2017. “One in Five Inpatient Emergency Department Cases May Lead to Surprise Bills.” Health Affairs. Vol 36. No. 1

4 Kirzinger, Ashley, Bryan Wu, Cailey Muñana, and Mollyann Brodie. “Kaiser Health Tracking Poll – Late Summer 2018: The Election, Pre-Existing Conditions, and Surprises on Medical Bills.” Henry J Kaiser Family Foundation, 2018.

5 Jack Hoadley, Kevin Lucia, and Maanasa Kona. “State Efforts to Protect Consumers from Balance Billing | Commonwealth Fund,” 2019.